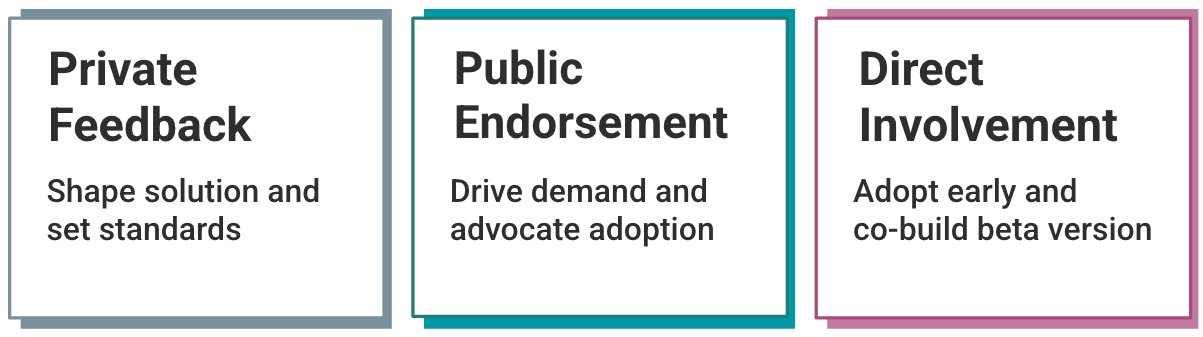

DSI welcomes input and collaboration from across the industry in three ways:

Collaborate with us on shaping a decentralized, privacy-preserving system for tokenized securities as outlined in our current framework.

Who we are

The Digital Securities Initiative is an open collaboration with no incorporated entity or member dues required to participate. Contributing organizations sponsor their own team members to spend time on the initiative when it is in their interest.

It was started by Confusion Capital, which is involved in the Reserve project. Reserve has a vision that depends on securities being available within DeFi, but is not itself involved in security tokenization and has no financial interest in any security tokenization company.

To learn more, read our introduction.